Xfinity vs Other Cable Internet Companies: Which Provider is Best Near You?

Let’s be honest – shopping for cable and internet near me feels like trying to solve a Rubik’s cube while blindfolded. You’re bombarded with confusing plans, mysterious fees, and sales representatives who speak in technical jargon that would make a NASA engineer scratch their head. Whether you’re moving to a new place, fed up with your current provider’s spotty service, or simply hunting for a better deal, finding the right cable internet companies can feel overwhelming.

The good news? You’re not alone in this digital wilderness. Millions of Americans face the same dilemma every year, trying to navigate the maze of cable internet bundles and figure out which provider actually delivers what they promise. From Xfinity’s widespread availability to smaller regional players, the landscape of cable providers in my area varies dramatically depending on where you live. Some folks in urban areas enjoy the luxury of choice, while others in rural locations might have limited options that make the decision easier – albeit sometimes frustratingly so.

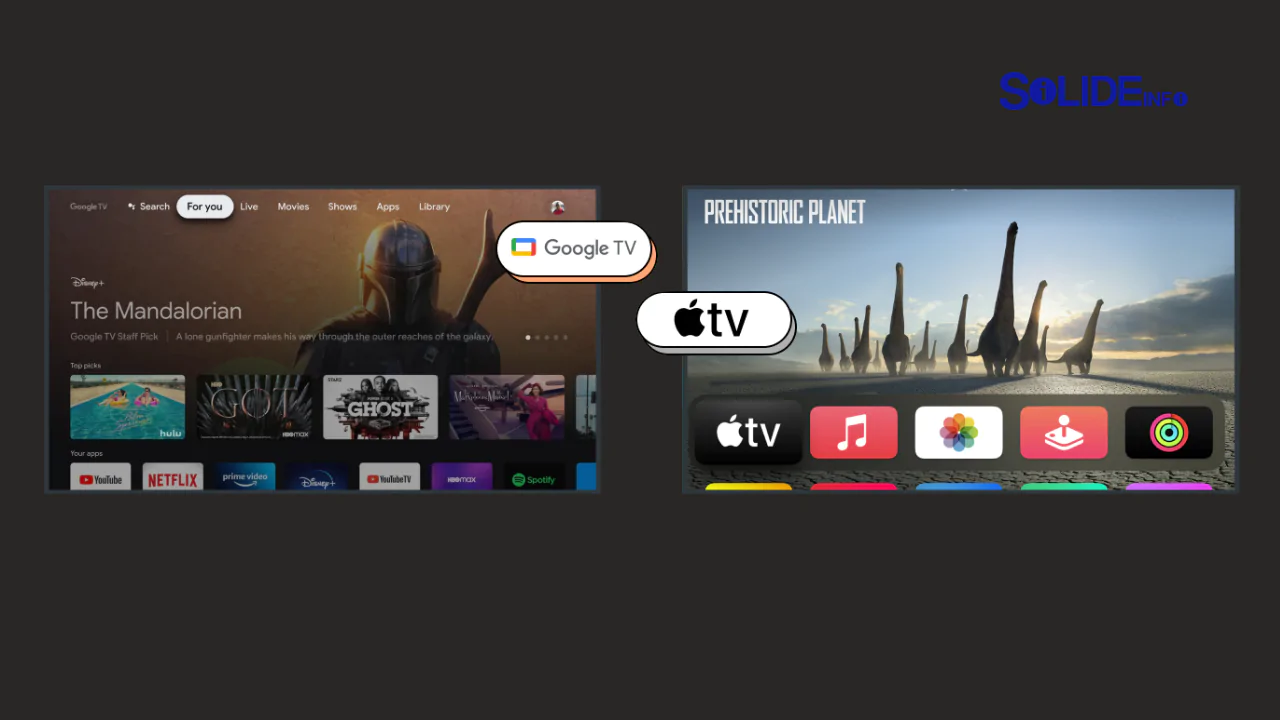

What makes this whole process even trickier is that internet needs have evolved dramatically. Gone are the days when checking email and browsing the web were our primary concerns. Today’s households are streaming 4K videos, working from home, gaming online, and running smart home devices that collectively demand serious bandwidth. This shift means that choosing the right xfinity cable internet or alternative provider isn’t just about price anymore – it’s about finding a service that can handle your digital lifestyle without breaking the bank or driving you to the brink of insanity with constant buffering.

Understanding the Cable Internet Landscape

The cable internet industry resembles a complex ecosystem where giants like Comcast Xfinity dominate vast territories while smaller, regional providers carve out their own niches. When you start searching for new cable service, you’ll quickly discover that availability often trumps preference. Unlike choosing a smartphone or laptop, where you can pick from dozens of options regardless of location, cable internet is inherently tied to physical infrastructure that companies have spent billions building over decades.

Xfinity ethernet speeds and coverage represent one of the most significant advantages of choosing Comcast as your provider. Their network reaches approximately 40% of American households, making them the largest cable internet provider in the country. This extensive reach means that in many areas, Xfinity isn’t just an option – it’s often the primary or sometimes only viable choice for high-speed internet. Their infrastructure investments over the years have resulted in a network capable of delivering gigabit speeds to most of their service areas, though the actual experience can vary significantly based on your specific location and neighborhood infrastructure.

However, the cable internet landscape isn’t a one-company show. Regional players like Cox Communications, Spectrum, and Optimum have built strong footholds in their respective markets, often providing competitive alternatives that sometimes surpass Xfinity in customer satisfaction or pricing. These companies understand their local markets intimately and can often provide more personalized customer service than larger national providers. The challenge lies in understanding what’s actually available in your specific area and how these options stack up against each other in terms of real-world performance, not just advertised speeds.

The technical backbone of cable internet relies on the same coaxial cables that traditionally delivered television signals to homes. This shared infrastructure model means that during peak usage times, you might experience slower speeds as you’re essentially sharing bandwidth with your neighbors. It’s like being on a highway during rush hour – the road is capable of high speeds, but traffic congestion can slow everyone down. This characteristic of cable internet is something that providers rarely discuss in their marketing materials, but it’s crucial to understand when comparing options.

Xfinity: The Industry Giant Under the Microscope

Comcast Xfinity has earned its position as the dominant force in American cable internet through decades of strategic acquisitions, infrastructure investments, and aggressive expansion. When most people think about cable internet companies, Xfinity typically comes to mind first, and for good reason. Their service reaches from major metropolitan areas to suburban communities, offering a range of plans that cater to different usage patterns and budget constraints.

One Reddit user from Philadelphia shared their experience: “I’ve had Xfinity for three years now, and honestly, it’s been pretty reliable. Sure, there was that one outage during a storm that lasted eight hours, but day-to-day performance has been solid. My only gripe is dealing with customer service when you need to make changes to your account – it’s like navigating a maze designed by someone who really doesn’t want you to find the exit.” This sentiment captures a common theme among Xfinity customers: generally satisfactory technical performance coupled with frustrating customer service experiences.

Xfinity cable internet plans typically start around $30-40 per month for basic speeds of 75-100 Mbps, which is adequate for light internet usage like browsing, social media, and streaming on one or two devices. Their mid-tier options, ranging from $50-70 monthly, offer speeds between 200-400 Mbps, suitable for households with multiple users and heavier streaming habits. At the premium end, Xfinity’s gigabit plans can cost $80-100+ per month, delivering speeds up to 1,000 Mbps or higher in some areas.

The reality of xfinity ethernet performance often depends on factors beyond the advertised speeds. Network congestion during peak hours (typically 7-11 PM) can significantly impact your actual experience, especially in densely populated areas where many neighbors share the same local infrastructure. Additionally, the quality of wiring in your home, the age of your modem and router, and even the weather can affect performance. Xfinity’s advantage lies in their extensive network maintenance and regular infrastructure upgrades, which help minimize these issues compared to smaller providers who might lack the resources for frequent improvements.

What sets Xfinity apart from many competitors is their comprehensive ecosystem of services. Beyond basic internet, they offer integrated solutions that include TV streaming, mobile phone service, home security, and even smart home automation. This bundling strategy can provide significant savings for customers who want multiple services, but it can also create a sense of being locked into their ecosystem. The convenience of having one bill and one customer service contact for multiple services appeals to many customers, even if individual components might be available cheaper elsewhere.

Spectrum: The Challenger with No Data Caps

Charter Spectrum positions itself as a customer-friendly alternative to Xfinity, with their most notable selling point being the absence of data caps on any of their plans. This policy alone makes them attractive to heavy internet users who stream extensively, work from home with large file transfers, or simply don’t want to worry about overage charges. In markets where both Xfinity and Spectrum compete directly, this difference often becomes a decisive factor for families with high data consumption.

A Spectrum customer from Austin, Texas, recently posted on Reddit: “Switched from Xfinity to Spectrum last year primarily because of the no-data-cap policy. I work from home and my kids are constantly streaming, gaming, and video chatting with friends. With Xfinity, I was constantly worried about hitting their 1.2TB limit, especially during months when everyone was home more. Spectrum’s pricing was comparable, and the peace of mind has been worth it.” This experience highlights how data policies can significantly impact the total cost of ownership beyond the advertised monthly rates.

Spectrum’s pricing structure tends to be more straightforward than Xfinity’s complex bundling options. Their internet plans typically start around $50 per month for speeds up to 300 Mbps, with higher-tier options reaching 500 Mbps or 1 Gig speeds depending on your location. While these promotional rates often increase after the first year or two, Spectrum’s pricing tends to be less convoluted than some competitors who layer on numerous fees and surcharges that can significantly inflate your monthly bill.

The technical infrastructure behind Spectrum’s service varies considerably by region, largely due to their growth through acquisitions of smaller cable companies. In some areas, customers report excellent performance and reliability, while others experience more frequent outages or slower speeds during peak times. This inconsistency reflects the challenge of integrating multiple legacy networks under a single brand, though Spectrum has been investing heavily in network upgrades and standardization across their service areas.

Customer service experiences with Spectrum tend to be mixed, though generally considered better than Xfinity’s reputation in this area. Their retention policies are often more flexible, and customers report having better success negotiating rates or resolving technical issues. However, like most large cable providers, Spectrum still faces challenges with long hold times and the need to escalate simple requests through multiple representatives before reaching resolution.

Cox Communications: Regional Excellence with Premium Pricing

Cox Communications operates as a regional powerhouse in markets across the Southwest and Southeast, building a reputation for reliable service and superior customer support compared to national giants. Their approach focuses on serving specific geographic markets exceptionally well rather than pursuing nationwide expansion, which allows them to maintain more consistent service quality and develop deeper relationships with local communities.

The pricing structure for Cox internet services typically reflects their positioning as a premium provider. Basic plans start around $40-50 monthly for speeds up to 100 Mbps, while their gigabit offerings can reach $100-120 per month. These rates are generally higher than comparable Xfinity or Spectrum options, but Cox customers often report that the service quality justifies the premium. Their network infrastructure tends to be well-maintained, with fewer peak-time congestion issues than some competitors.

A Cox customer from San Diego shared their perspective: “I’ve been with Cox for over five years, and while they’re definitely not the cheapest option, I’ve never had a major outage, and their customer service actually answers the phone promptly. Last month, a technician came out within two days to resolve a connection issue – no charge, no hassle. You pay more, but you get what you pay for.” This sentiment reflects Cox’s strategy of competing on service quality rather than purely on price.

Cox’s cable internet bundles often include attractive television packages and additional services that can provide good value for customers who want comprehensive entertainment solutions. Their Contour TV platform integrates streaming services with traditional cable channels, creating a unified viewing experience that appeals to households transitioning from traditional cable to streaming-first entertainment consumption. The integration works particularly well when combined with their internet service, as the system is optimized to work seamlessly together.

One area where Cox excels is in their approach to customer education and support. Their technicians are generally well-trained and take time to explain system configurations, optimal router placement, and troubleshooting steps that customers can perform themselves. This educational approach reduces future service calls and helps customers get better performance from their internet connection, contributing to higher overall satisfaction rates compared to providers who focus purely on installation speed and volume.

Optimum: East Coast Focused with Competitive Pricing

Optimum serves primarily Northeast markets including New York, New Jersey, Connecticut, and Pennsylvania, where they compete directly with Xfinity and other major providers. Their strategy emphasizes competitive pricing and straightforward plan structures, though their reputation for customer service and reliability has been inconsistent over the years, particularly following their acquisition by Altice USA.

The current Optimum internet lineup typically features promotional pricing that starts around $35-40 monthly for speeds up to 300 Mbps, making them one of the more affordable options in their service areas. Their gigabit plans usually price around $65-80 per month, which represents significant savings compared to Xfinity’s premium offerings in the same markets. However, customers should be aware that these promotional rates typically expire after 12-24 months, after which prices can increase substantially.

Recent infrastructure investments by Optimum have focused on fiber-optic upgrades in select areas, which can provide more consistent speeds and better upload performance than traditional cable technology. However, fiber availability remains limited to newer developments and certain neighborhoods where the economics support the infrastructure investment. Most Optimum customers still receive service through traditional cable infrastructure, which means performance can vary based on neighborhood congestion and network maintenance schedules.

Customer experiences with Optimum tend to be polarized – some customers report excellent value and reliable service, while others complain about frequent outages and poor customer support. A recent review from a Long Island customer illustrates this divide: “Optimum has been great for us price-wise, and our internet rarely goes down. But when we needed to upgrade our plan last year, it took three phone calls and two different technician visits to get everything working properly. The technical service is fine, but their internal communication seems to be a mess.”

The cable internet bundles offered by Optimum can provide good value for customers who still want traditional TV service alongside their internet connection. Their television packages include access to popular streaming apps and on-demand content, though the interface and user experience generally lag behind more modern platforms offered by competitors. For customers primarily focused on internet service with minimal TV viewing, their internet-only plans often represent better value than bundled options.

Smaller Regional Players: Hidden Gems in Specific Markets

Beyond the major national and regional providers, numerous smaller cable companies serve specific cities, counties, or rural areas throughout the country. These cable providers in my area might not have the marketing budget or brand recognition of larger competitors, but they often provide superior customer service and competitive pricing within their service territories. Companies like Mediacom in the Midwest, Cable One (now Sparklight) in smaller markets, and various municipal broadband providers represent alternatives worth considering.

Municipal broadband providers deserve special attention as they represent a growing trend toward community-owned internet infrastructure. Cities like Chattanooga, Tennessee, and Longmont, Colorado, have developed their own fiber networks that often provide faster speeds and better customer service than commercial alternatives. These community-owned networks typically reinvest profits back into infrastructure improvements and service expansion rather than distributing them to shareholders, which can result in better long-term value for residents.

One resident of Chattanooga shared their experience with the city’s EPB fiber network: “Moving here from a city with only Comcast options was like stepping into the future. Gigabit speeds for $70/month, no data caps, and when you call customer service, you talk to someone local who actually understands the network. It’s night and day compared to dealing with national cable companies.” This experience highlights how smaller, locally-focused providers can sometimes deliver superior service through their ability to maintain closer relationships with customers.

Rural cable providers face unique challenges in serving lower-density areas where the economics of cable infrastructure become more difficult. Companies like Rise Broadband and various regional providers often focus on fixed wireless or hybrid solutions that can reach areas where traditional cable or fiber deployment would be cost-prohibitive. While these services might not match the speeds available in urban areas, they often represent the best available option for customers in rural locations who previously relied on satellite internet or slow DSL connections.

The key to evaluating smaller providers lies in understanding their local reputation and infrastructure investments. Online reviews, local social media groups, and word-of-mouth recommendations from neighbors can provide valuable insights that aren’t available through traditional comparison websites. Many of these providers offer more personalized customer service and flexibility in plan customization, which can be particularly valuable for customers with specific needs or usage patterns.

Comparing Real-World Performance: Beyond Advertised Speeds

When evaluating cable internet companies, the gap between advertised speeds and real-world performance can be substantial, making direct comparisons challenging. Factors like network congestion, infrastructure age, and local competition all influence the actual speeds you’ll experience in your home. Understanding these variables helps set realistic expectations and guides better decision-making when choosing between providers.

Peak-time performance represents one of the most critical factors that rarely appears in provider marketing materials. Cable internet operates on a shared infrastructure model, meaning that your actual speeds depend partly on how many neighbors are simultaneously using the network. During evening hours when families are streaming Netflix, kids are gaming online, and adults are video conferencing for work, available bandwidth gets distributed among all active users in your neighborhood.

Independent speed testing data from sources like Ookla’s Speedtest.net provides more realistic insights into provider performance than advertised specifications. According to recent data, Xfinity customers typically achieve 85-95% of advertised speeds during off-peak hours, dropping to 70-85% during prime time. Spectrum customers generally see similar patterns, though their no-data-cap policy means performance doesn’t degrade due to throttling for high-usage customers. Cox tends to deliver more consistent speeds throughout the day, though their higher pricing reflects the infrastructure investments required to maintain this consistency.

Upload speeds often reveal significant differences between providers that aren’t apparent from their download speed marketing. Traditional cable infrastructure typically provides asymmetrical service, with upload speeds ranging from 10-35 Mbps even on high-speed download plans. This limitation can significantly impact customers who work from home with video conferencing, upload large files, or operate home-based businesses. Providers investing in fiber infrastructure or DOCSIS 3.1 upgrades generally offer better upload performance, though availability varies significantly by location.

Latency, or the delay between sending a request and receiving a response, affects real-time applications like gaming, video calls, and interactive streaming more than raw speed measurements indicate. Cable internet typically provides latency in the 15-30 millisecond range, which is adequate for most applications but may not satisfy competitive gamers or applications requiring real-time response. Fiber-based services generally offer lower latency, while older cable infrastructure or congested networks may experience higher delays during peak usage periods.

Understanding Pricing: The Hidden Costs Beyond Monthly Rates

The sticker price advertised for cable and internet near me options represents just the starting point for understanding your total costs. Equipment rental fees, installation charges, activation fees, and various surcharges can add $20-40 monthly to your base internet rate, significantly impacting the actual cost comparison between providers. Understanding these additional charges helps avoid surprises on your first bill and enables more accurate cost comparisons.

Equipment rental fees represent one of the most common sources of bill shock for new customers. Most providers charge $10-15 monthly for modem rental, plus an additional $5-10 for WiFi router functionality. Over a two-year period, these fees can total $360-600, which often exceeds the cost of purchasing your own compatible equipment. However, buying your own modem and router requires research to ensure compatibility and may void certain service guarantees, creating a trade-off between cost savings and convenience.

Installation and activation fees vary significantly between providers and can often be negotiated during the sign-up process. Standard professional installation typically costs $50-100, though many providers waive this fee during promotional periods or for customers who bundle multiple services. Self-installation kits are usually free but require comfort with basic technical setup and troubleshooting if issues arise during the process.

Promotional pricing represents another area where advertised rates can be misleading. Most cable internet bundles feature introductory rates that increase after 12-24 months, sometimes doubling the monthly cost. Xfinity’s promotional rates might start at $40 monthly but jump to $70+ after the promotional period expires. Reading the fine print and understanding post-promotional pricing helps avoid budget surprises and enables better long-term cost planning.

Data overage charges can significantly impact customers of providers who implement monthly usage caps. Xfinity’s 1.2TB monthly limit sounds generous but can be exceeded by households with multiple streaming devices, remote workers, or gamers who download large files regularly. Overage charges typically run $10-15 per 50GB block, which can add substantial costs for high-usage customers. Spectrum’s no-data-cap policy provides peace of mind for customers worried about usage-based charges, though their base rates may be higher to compensate for this policy.

Early termination fees and contract requirements vary between providers and can impact your flexibility if you need to move or change services. Some providers offer month-to-month service at higher rates, while others require 12-24 month commitments with penalties for early cancellation. Understanding these terms becomes particularly important for renters or customers who might relocate during the contract period.

The Bundle Trap: When Packages Save Money and When They Don’t

Cable internet bundles represent a complex value proposition that can either provide significant savings or lock customers into paying for services they don’t need. The key to navigating bundle offers lies in honestly assessing your actual usage patterns and comparing the total bundle cost to purchasing individual services separately. This analysis becomes more complicated as streaming services continue to replace traditional cable TV, changing the value equation for many households.

Traditional triple-play bundles combining internet, TV, and phone service often appear attractively priced during promotional periods but can become expensive once regular pricing takes effect. A typical Xfinity bundle might start at $79.99 monthly for internet, basic TV, and phone service, but increase to $130+ after promotions expire. For customers who rarely use landline phones and prefer streaming services to traditional cable channels, the bundle may represent poor value despite the apparent savings.

However, bundles can provide genuine value for customers who actively use multiple services and appreciate the convenience of single billing. Families who watch sports, news, or premium cable channels that aren’t readily available through streaming services may find that bundled TV service costs less than maintaining separate internet service plus multiple streaming subscriptions. The calculation becomes particularly favorable when internet-only pricing from the same provider approaches the promotional bundle price.

Modern bundles increasingly focus on internet plus streaming services rather than traditional cable TV. Xfinity’s partnerships with streaming platforms and their own Peacock service create bundle opportunities that align better with changing viewing habits. Similarly, some providers offer bundles that include popular streaming services like Netflix or Disney+ as part of their package, potentially providing savings for customers who would subscribe to these services independently.

The challenge with most bundle evaluations lies in accurately predicting your usage patterns over the contract period. Customers who sign up for TV service as part of a bundle but rarely use it end up paying for unused value, while those who discover they want additional channels or premium services may find themselves paying extra fees that eliminate bundle savings. Honestly assessing your viewing habits and considering how they might change over the contract period helps guide better bundle decisions.

Mobile phone integration represents an increasingly important component of modern cable internet bundles. Providers like Xfinity Mobile leverage existing customer relationships and infrastructure to offer competitive wireless service, particularly for customers who primarily use WiFi and need minimal cellular data. These integrated bundles can provide substantial savings for light mobile users while simplifying billing and customer service interactions.

Installation and Customer Service: The Experience Beyond the Technology

The quality of installation and ongoing customer service often determines long-term satisfaction with new cable service more than technical specifications or pricing. A smooth installation process and responsive customer support can make even minor technical issues manageable, while poor service can turn an excellent technical product into a source of ongoing frustration. Understanding each provider’s approach to customer service helps set expectations and identify potential red flags.

Professional installation quality varies significantly between providers and even between individual technicians from the same company. Xfinity’s large technician network means that service quality can be inconsistent, though their extensive training programs and standardized procedures generally ensure competent installations. The best installations involve technicians who take time to explain the system, optimize WiFi placement, and test performance throughout your home rather than simply connecting equipment and leaving.

One customer from Denver shared their installation experience: “The Xfinity tech who came out was fantastic – he spent almost two hours making sure everything was perfect. He tested speeds in different rooms, adjusted the router placement, and even helped me connect my smart TV. But when I needed a follow-up visit for a different issue, the next technician was clearly rushing and barely tested anything. It’s really hit-or-miss depending on who you get.” This experience highlights the inconsistency that can exist even within single companies due to different training levels and performance incentives.

Customer service responsiveness becomes crucial when technical issues arise or when you need to make account changes. Smaller providers often excel in this area due to local operations and lower customer-to-representative ratios, while larger providers may struggle with long hold times and representatives who lack authority to resolve complex issues. Cox’s reputation for superior customer service reflects their investment in training and their policy of empowering representatives to resolve issues without excessive escalation requirements.

Self-service options and online account management can significantly reduce the need for direct customer service contact. Xfinity’s app and website provide comprehensive account management, troubleshooting tools, and service scheduling that can handle many routine interactions without phone calls. However, complex issues or unusual situations often still require human intervention, making the quality of live customer support remain important even for tech-savvy customers.

Technical support quality becomes particularly important for customers who aren’t comfortable troubleshooting network issues independently. The ability to reach knowledgeable technical support staff who can walk through diagnostic steps, schedule technician visits when necessary, and provide clear explanations of problems and solutions adds significant value to any service relationship. Providers who invest in technical training for their support staff generally achieve higher customer satisfaction ratings and reduce repeat service calls.

Making the Decision: Factors Beyond Speed and Price

Choosing the best cable providers in my area requires balancing multiple factors that extend beyond simple speed and price comparisons. Your specific usage patterns, household size, technical comfort level, and long-term stability all influence which provider offers the best overall value for your situation. Creating a decision framework that weighs these factors according to your priorities helps cut through marketing noise and provider complexity.

Reliability and consistency often matter more than peak speeds for many users. A connection that consistently delivers 200 Mbps is more valuable than one that occasionally reaches 500 Mbps but frequently drops to 50 Mbps during peak usage times. Customer reviews, local social media groups, and informal surveys of neighbors can provide insights into real-world reliability that aren’t captured in technical specifications or marketing materials.

Future scalability represents another important consideration as your internet needs will likely increase over time. Plans that seem adequate today may feel constraining as new devices, applications, and usage patterns emerge. Choosing a provider with a clear upgrade path and reasonable pricing for higher-tier services provides flexibility to adapt without switching providers or facing significant cost increases.

Contract flexibility and customer service quality become particularly important for customers who value the ability to make changes or resolve issues quickly. Month-to-month services cost more than contracted plans but provide freedom to switch if better options become available or if service quality deteriorates. Conversely, customers comfortable with longer commitments may prefer the savings and rate stability that comes with contracted service.

Local competition dynamics also influence the long-term value proposition of different providers. In markets with strong competition, providers typically offer better rates, invest more heavily in infrastructure improvements, and maintain higher customer service standards. Areas with limited competition may see higher prices and less responsive service over time, making provider stability and reputation more important factors in the decision process.

Technical support and installation quality particularly matter for customers who aren’t comfortable with network troubleshooting or equipment management. Providers with strong reputations for customer education and patient technical support can provide significant value for users who need assistance optimizing their service or resolving technical issues that arise over time.

The Future of Cable Internet: Technology Trends and Market Changes

The cable internet landscape continues evolving rapidly as new technologies, changing consumer preferences, and increased competition reshape the market. Understanding these trends helps inform long-term decisions about xfinity cable internet and alternative providers, particularly for customers considering multi-year contracts or significant infrastructure investments in their homes.

DOCSIS 4.0 technology represents the next major evolution in cable internet infrastructure, potentially enabling speeds up to 10 Gbps over existing coaxial cable networks. Major providers including Xfinity are beginning pilot deployments of this technology, though widespread availability remains several years away. This advancement could significantly extend the competitive lifespan of cable infrastructure against fiber-optic alternatives, though actual implementation and pricing remain to be determined.

Fiber-to-the-home deployment continues accelerating as providers seek to differentiate their services and future-proof their networks. While traditional cable companies have been slower to invest in fiber compared to telecommunications providers, companies like Xfinity are increasingly deploying fiber in new developments and areas where infrastructure upgrades are economically viable. This trend suggests that future cable internet companies may actually be fiber companies using established cable company brands and customer relationships.

5G fixed wireless service represents an emerging competitive threat to traditional cable internet, particularly in areas where cable infrastructure is limited or expensive to maintain. Verizon and T-Mobile are aggressively expanding their 5G home internet offerings, which can provide competitive speeds without requiring physical cable connections to homes. While current 5G coverage remains limited and performance can be inconsistent, this technology could significantly change rural and suburban internet options over the next 5-10 years.

Streaming service integration continues reshaping cable internet bundles as providers adapt to cord-cutting trends. Rather than competing with streaming services, cable companies are increasingly partnering with or acquiring streaming platforms to create value-added bundles that maintain customer relationships despite declining traditional TV subscriptions. This evolution suggests that future bundles may look very different from current offerings, potentially focusing on premium internet service combined with curated streaming content.

Municipal broadband and community-owned networks represent a growing alternative to commercial cable providers, particularly in areas where residents are dissatisfied with existing options. While political and regulatory barriers limit the expansion of municipal broadband, successful examples in cities like Chattanooga and Longmont demonstrate the potential for community-owned infrastructure to provide superior service at competitive prices. This trend may pressure commercial providers to improve service quality and pricing in markets where municipal alternatives are being considered.

Net neutrality regulations and data privacy policies continue evolving at both federal and state levels, potentially affecting how providers manage network traffic and customer data. While these policy changes primarily affect provider operations rather than customer experience directly, they can influence long-term pricing, service policies, and the competitive landscape between different types of internet providers.

Conclusion: Finding Your Perfect Internet Match

Navigating the world of cable and internet near me options doesn’t have to feel like solving a puzzle designed by someone who clearly doesn’t want you to succeed. While the landscape of cable internet companies can seem overwhelming with their various plans, pricing structures, and service territories, understanding your specific needs and asking the right questions can lead you to the perfect provider for your situation.

The key takeaway is that there’s no universally “best” provider – only the best provider for your specific combination of location, usage patterns, budget constraints, and service preferences. Xfinity cable internet might be the ideal choice for customers who value extensive coverage and comprehensive service bundles, while Spectrum’s no-data-cap policy could make them perfect for heavy internet users. Cox’s premium service approach appeals to customers who prioritize reliability and customer support, while smaller regional providers might offer superior value and personalized service in their specific markets.

Remember that cable internet bundles and promotional pricing can significantly affect your long-term costs, so factor in post-promotional rates and additional fees when making comparisons. Don’t be afraid to negotiate with providers, ask about current promotions, or leverage competing offers to secure better rates. The internet service market is competitive enough that most providers have flexibility in their pricing, particularly for new customers or those willing to commit to longer contracts.

As you embark on your search for the perfect new cable service, take time to research what’s actually available in your area, read recent customer reviews, and consider your future needs alongside current requirements. The internet service you choose today will likely be part of your daily life for years to come, making it worth investing the time to make an informed decision rather than simply choosing the first option that seems reasonable.

Whether you end up with xfinity ethernet speeds powering your home network or find that a regional provider offers the perfect combination of service and value, the most important thing is choosing a provider that aligns with your needs and expectations. Take control of your internet experience, do your homework, and don’t settle for a service that leaves you frustrated every time you try to stream your favorite show or join a video call.

What’s your experience been with cable internet providers in your area? Have you found a provider that exceeded expectations, or are you still searching for that perfect combination of speed, reliability, and reasonable pricing? Share your thoughts and help fellow internet seekers navigate this complex but essential decision.

- Learn more about protecting your home network with our comprehensive cybersecurity guide for home users

- Discover how AI is revolutionizing network management and optimization

- Explore blockchain applications in telecommunications infrastructure

- Find out how home automation systems integrate with your internet connection

- Stay updated on cryptocurrency trends affecting the tech industry

- FCC Broadband Availability Maps

- Consumer Reports Internet Provider Ratings