The internet as we know it is undergoing a significant transformation with the advent of Web3. Built on blockchain technology, Web3 is a decentralized, user-controlled system that aims to revolutionize the way we interact with the online world. Unlike Web2, which relies heavily on centralized platforms like banks, corporations, and big tech companies, Web3 enables peer-to-peer interactions without the need for intermediaries. This shift is not only reshaping the internet but is also poised to disrupt industries, particularly finance, by creating a more open, transparent, and secure ecosystem.

Web3 represents the next phase in the evolution of the internet, one where control shifts from a few powerful entities to the individual users themselves. In this decentralized web, users have direct ownership over their data, digital assets, and online interactions. The implications of this are profound, particularly in sectors like finance, where trust, security, and transparency are paramount. As Web3 gains traction, it promises to create a financial landscape that is more inclusive, cost-effective, and efficient, offering vast opportunities for innovation.

Key Features of Web3: Decentralization, Blockchain, and Smart Contracts

One of the foundational principles of Web3 is decentralization. In contrast to the centralized control of Web2, where platforms like Facebook and Google have significant power over user data, Web3 distributes control across a network of nodes. This decentralization ensures that no single entity can dominate the ecosystem, fostering a fairer and more equal playing field. By breaking down the traditional hierarchies of control, Web3 empowers individuals and reduces the reliance on intermediaries, allowing for more direct, peer-to-peer interactions.

At the heart of Web3 is blockchain technology, which serves as a transparent and immutable ledger for recording transactions. This technology enhances trust within the system by ensuring that all interactions are secure and verifiable. Every transaction on the blockchain is recorded in a way that cannot be altered or tampered with, creating a high level of accountability and transparency. This is particularly important in finance, where trust is often placed in third-party institutions. With Web3, blockchain replaces these intermediaries, allowing for more direct and transparent financial interactions.

Another key component of Web3 is the use of smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. When certain conditions are met, the contract automatically executes, eliminating the need for intermediaries to enforce the contract. This automation reduces transaction costs and increases efficiency, making processes faster and more reliable. In finance, smart contracts are especially valuable as they can streamline operations like lending, borrowing, and trading without the need for traditional financial institutions.

Web3’s Impact on Finance: DeFi, Accessibility, and Security

The financial sector stands to benefit enormously from the rise of Web3, particularly through the development of Decentralized Finance, or DeFi. DeFi aims to replace traditional financial intermediaries, such as banks, with blockchain-powered services. These services operate without the need for centralized oversight, allowing users to access financial products like loans, savings accounts, and trading platforms in a decentralized manner. The core promise of DeFi is to democratize finance by making it more accessible, inclusive, and efficient.

One of the most significant advantages of Web3 in finance is its potential to increase accessibility. Traditional financial systems often exclude large portions of the global population, particularly in developing countries where access to banking infrastructure is limited. Web3, through its decentralized and peer-to-peer nature, bypasses these barriers, providing financial services to unbanked populations. Anyone with an internet connection can participate in the Web3 financial ecosystem, enabling greater financial inclusion and economic opportunity for underserved communities.

Web3 also enhances security in the financial sector. Blockchain’s transparency and immutability significantly reduce the risk of fraud and unauthorized access. Every transaction is independently verifiable on a public ledger, making it nearly impossible to alter records or engage in fraudulent activity. This heightened level of security is especially important in finance, where trust in the system is crucial. By providing a secure and transparent alternative to traditional financial systems, Web3 offers a more trustworthy environment for users.

In terms of cost efficiency, Web3’s ability to eliminate intermediaries reduces transaction fees, making the financial system more cost-effective. Traditional financial transactions often involve multiple parties, each taking a fee for their services. With Web3, these intermediaries are no longer needed, resulting in lower costs for users. This reduction in costs, combined with the increased speed and automation provided by smart contracts, makes Web3 a more efficient alternative to the traditional financial system.

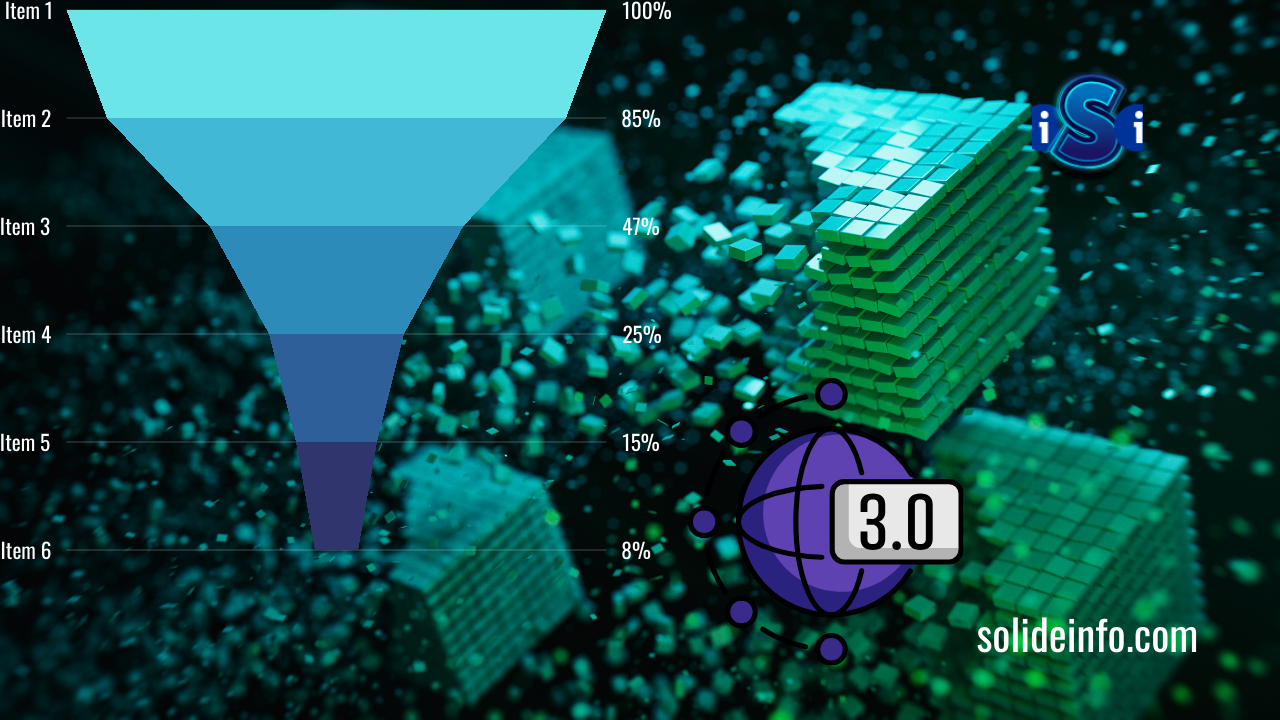

Web3 vs. Web2: Control, Transparency, and Efficiency

One of the key differences between Web2 and Web3 is control and ownership. In the current Web2 model, platforms like Google, Facebook, and banks have control over user data and digital assets. They act as intermediaries in online interactions, often collecting, storing, and profiting from user information. In Web3, control shifts to the users. Through decentralized networks and blockchain technology, individuals can own and control their data and digital assets without the need for third-party intermediaries. This shift in control represents a fundamental change in the way we interact with the internet and our online identity.

Another major distinction between Web2 and Web3 is the role of intermediaries. In Web2, most online transactions require intermediaries, whether it’s a bank verifying a financial transaction or a social media platform managing data. Web3 eliminates these intermediaries by allowing users to interact directly with each other via blockchain technology. This not only improves efficiency by reducing the time and cost associated with transactions but also gives users more autonomy over their interactions and data.

Transparency is also a defining feature of Web3. Unlike the opaque processes of Web2, where companies control data and processes behind closed doors, Web3 operates on an open, transparent ledger. All transactions are visible on the blockchain, ensuring that anyone can audit and verify the accuracy of the data. This transparency reduces the risk of fraud and increases trust in the system, making it a more reliable option for financial transactions and other online activities.

Conclusion: The Future of Finance with Web3

Web3 holds the potential to completely transform the financial sector by creating a more inclusive, secure, and efficient system. Through decentralized finance (DeFi), increased accessibility, enhanced security, and reduced costs, Web3 offers a compelling alternative to the traditional financial system. While there are still challenges to overcome, such as regulatory uncertainty and potential security vulnerabilities, the overall impact of Web3 on finance is expected to be profound.

As more industries begin to adopt blockchain technology and embrace decentralization, the future of finance will likely be shaped by Web3’s ability to offer increased transparency, control, and inclusivity. The shift from Web2 to Web3 is not just a technological upgrade but a fundamental change in how we interact with the online world. This revolution has the potential to redefine the global financial system, providing opportunities for innovation and growth that could benefit individuals and businesses alike.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult with a financial professional before making any investment decisions.