Despite Trump’s backing, crypto is choosing MiCA over America: Paybis

It’s a striking trend reshaping the crypto landscape: European regulation, notably the Markets in Crypto-Assets framework (MiCA), is gaining favor among blockchain businesses and investors despite former President Trump’s vocal advocacy for American crypto dominance. One stark indicator comes from crypto exchange Paybis, whose EU customer trading volumes surged 70% quarter-on-quarter in early 2025 as MiCA took effect—while U.S. activity declined. Paybis co-founder Konstantins Vasilenko attributes this to MiCA offering something the fragmented U.S. market lacks: certainty. Europe’s unified approach is building trust, prompting firms to prioritize compliance there while navigating America’s regulatory fog.

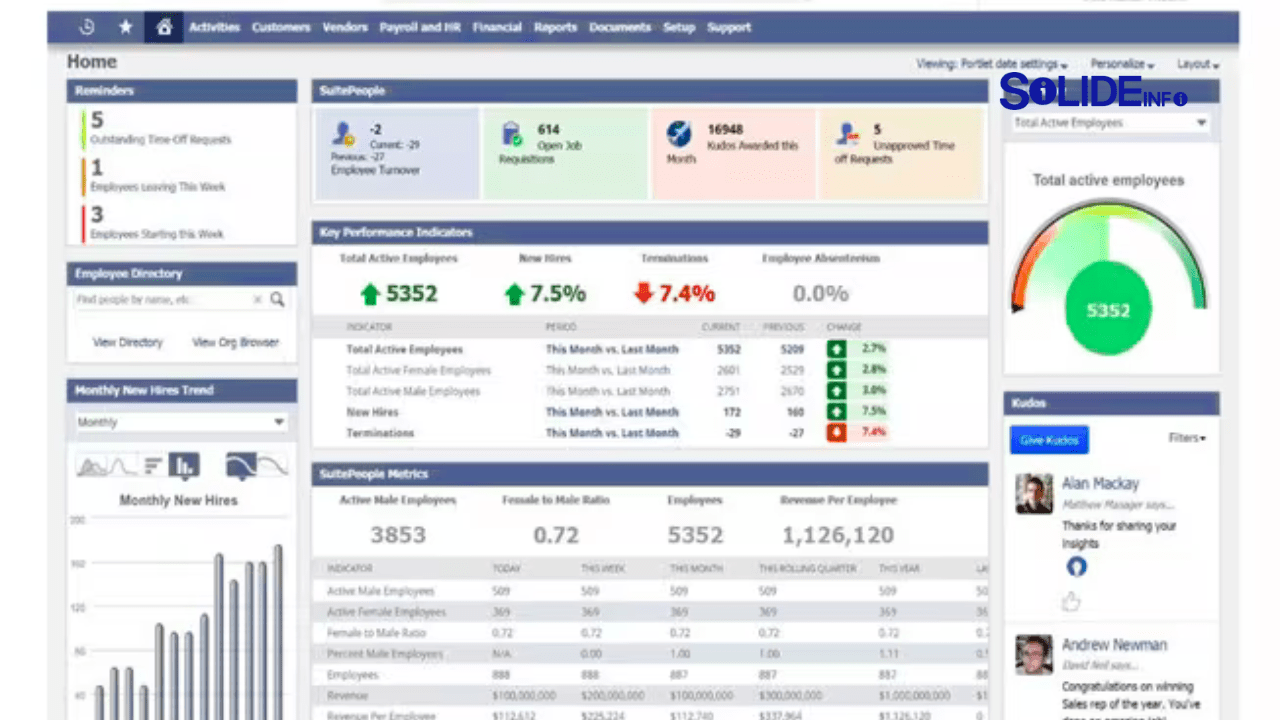

The Proof in the Data

Paybis isn’t alone in reporting a dramatic European uptick alongside U.S. struggles. Vasilenko noted that EU users began placing “larger, more deliberate trades” right after MiCA’s licensing window opened on January 1, 2025—timing too precise to dismiss. Broader market data reinforces this: analysts at Kaiko found retail trading on Coinbase plummeted to just 18% of its volume in 2025, down from 40% in 2021. Similarly, Robinhood saw crypto trading activity fall 35% quarterly in Q1 2025. The pattern signals a loss of U.S. retail engagement, contrasting sharply with Europe’s growing confidence. This shift isn’t fleeting; platforms like Coinbase, OKX, and Crypto.com are publicly prioritizing MiCA licenses as key growth catalysts.

Why Europe is Winning Trust

MiCA’s appeal lies in its clarity and safeguards. Once authorized in one EU nation, firms can “passport” licenses across the entire bloc—eliminating regulatory whiplash between markets. Vasilenko emphasizes this mobility: retail clients “know their legal protections travel with them.” Equally crucial are MiCA’s strict stablecoin rules, enforcing 1:1 reserves, audits, and asset segregation. Combined with familiar MiFID-style rules—clear disclosures, cooling-off periods, and transparent pricing—it creates a predictable environment. Meanwhile, the U.S. suffers from “policy procrastination.” Despite Trump’s pro-crypto rhetoric, a cohesive federal framework remains absent. Investors face a maze of state licenses, unresolved SEC lawsuits, and sudden crypto delistings. This regulatory chaos, clashing with Trump’s supportive stance, weakens market stability and deters participation. Security and user protection anchors like CISA frameworks and IBM’s security protocols underscore how critical consistent oversight is—something MiCA directly delivers.

European Momentum Beyond MiCA

National innovation within the EU further accelerates this advantage. France saw Paybis activity explode by 175%, driven by Paris’s fintech hubs like Station F and its head start via the 2019 PACTE Act (mandating AML registration early). With crypto penetration predicted at 24% nationally, France epitomizes engaged adoption. Germany leverages its institutional strength, with Deutsche Boerse’s Clearstream poised to offer crypto settlement—bridging traditional finance and blockchain. Smaller nations like the Netherlands also punch above their weight through payment infrastructure. This momentum extends beyond trading; it reflects deeper confidence in Europe’s tech governance and cybersecurity standards. While the U.S. debates boundaries, Europe executes—turning regulatory vision into measurable economic activity and positioning MiCA as the global benchmark others must now chase.