Investing in global markets has never been more accessible, and HabitTrade is at the forefront of this revolution. The platform offers a seamless way to invest in U.S. and Hong Kong stocks, cryptocurrencies, ETFs, and options, all through a single integrated account. Whether you’re an experienced investor or just getting started, HabitTrade makes it easy to explore a variety of asset classes and build a diversified portfolio. Below, we break down how you can make the most of HabitTrade’s offerings.

Access to Global Stocks and Crypto

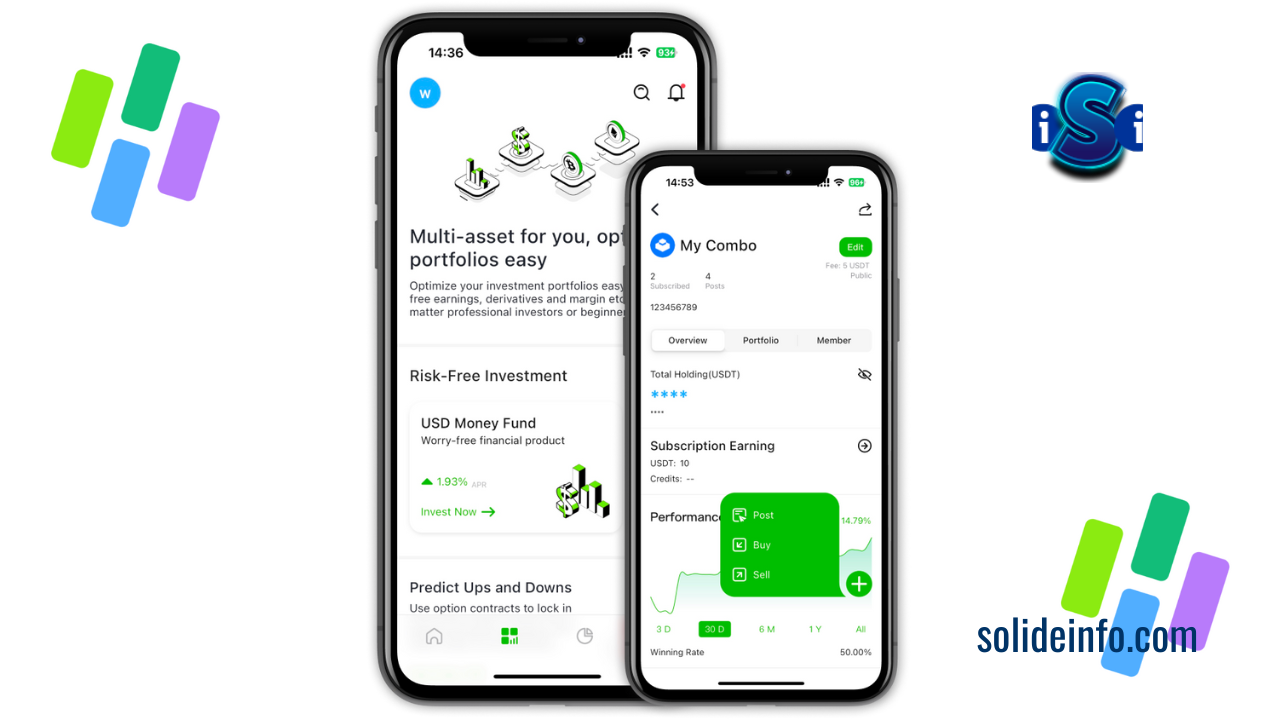

HabitTrade provides access to over 7,500 publicly traded companies, including household names like Apple (AAPL) and Tesla (TSLA). Beyond traditional stocks, the platform supports over 380 cryptocurrency pairs, allowing you to invest in both established digital currencies like Bitcoin and emerging altcoins. With real-time market data, financial analyses, and automated investing options, HabitTrade ensures that you can make informed decisions regardless of your investment style. Features like Copy Trading further enhance the experience, enabling users to replicate the portfolios of successful investors, which is especially beneficial for beginners looking to enter the market with confidence.

Security, Lower Fees, and User-Friendly Experience

In addition to offering a wide range of assets, HabitTrade places a strong emphasis on security and ease of use. The platform is governed by strict regulatory oversight, ensuring your funds and personal information are protected at all times. HabitTrade is also designed for a smooth and intuitive user experience, with lower trading fees that allow you to maximize returns. The platform’s rewards system lets users earn points by trading or referring friends, adding even more value to the overall investment experience. Whether you’re trading stocks, ETFs, or crypto, HabitTrade provides a comprehensive and secure solution for global investing.

This content is for informational purposes only and does not constitute investment advice. All investments involve risk. Please conduct thorough research or consult a financial advisor before making any investment decisions.

By Mohamed ElGhazi